Highlights:

- Bangladesh’s foreign loans increasingly shift to market-based high-interest rates

- Concessional loans shrinking, not directly tied to LDC graduation

- SOFR-linked loans now costly, reclassified as non-concessional

- Yen-denominated borrowing grows but carries rising currency risks

- World Bank, ADB concessional windows shrinking, repayment terms shortening

- Japan, China raising loan rates; concessional terms less available

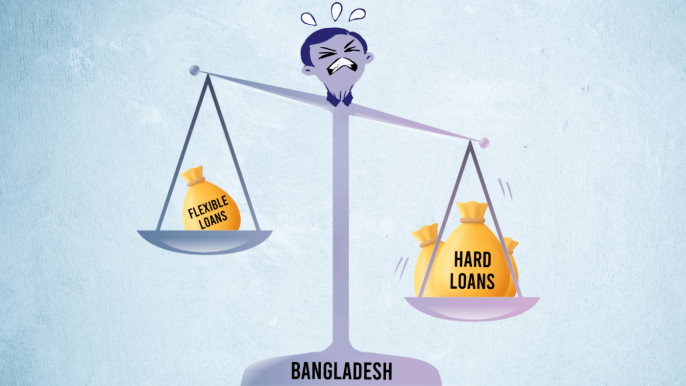

Bangladesh’s access to concessional foreign loans has been shrinking even before its graduation from Least Developed Country (LDC) status, with nearly half of last fiscal year’s borrowings now based on market rates.

Officials and analysts believe this shift indicates that the impact of LDC graduation on concessional financing will be limited as the decline in soft loans has been seen for years now.

They noted that concessional lending by institutions such as the World Bank (WB), the Asian Development Bank (ADB), and bilateral lenders like Japan and China is not directly tied to LDC status.

According to data from the Economic Relations Division (ERD), market-based loans with floating interest rates surged sharply – to 42.7% in the fiscal 2024-25 from 28.2% of the year before.বিস্তারিত

Keep updated, follow The Business Standard’s Google news channel

Keep updated, follow The Business Standard’s Google news channel