Online Report

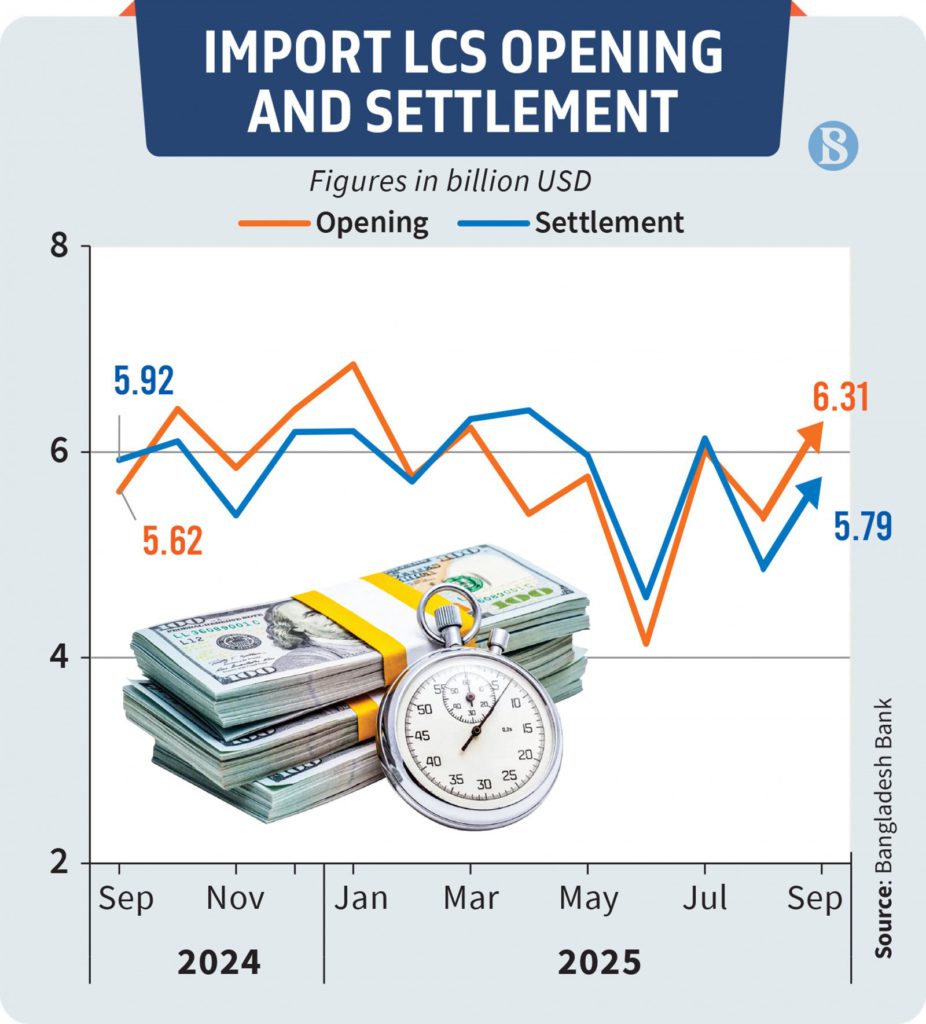

The value of Letters of Credit (LCs) opened in Bangladesh stood at $6.3 billion in September, marking a 17.29% increase from August, according to Bangladesh Bank’s Monthly Economic Indicators report.

The report shows that in August 2025, importers opened LCs worth $5.38 billion. With September’s rise, import activity has increased after eight months, though it remains below January 2025’s figure of $6.84 billion.

The figures indicate a rebound after a prolonged slowdown in both LC openings and settlements.

Bankers attribute the growth to an adequate supply of dollars in commercial banks and the central bank’s relaxation of stringent conditions on all types of imports.

The Business Standard Google News Keep updated, follow The Business Standard’s Google news channel

A senior Bangladesh Bank official told The Business Standard that a monthly LC opening of over $6 billion is reasonable, noting that LC activity in August this year and September 2024 was relatively low. LCs in September were predominantly opened for consumer goods, food items, raw materials, and government fertiliser imports.

He said for the country’s economy to be fully operational, an additional $2 billion in monthly imports would be required. “Most businessmen are waiting for the next general election. New investment in the industrial sector is expected to increase after the election, and then the volume of imports will also rise further,” the banker said.

In a recent meeting with the owners of the country’s top 20 business enterprises, Bangladesh Bank Governor Ahsan H Mansur instructed banks to ensure sufficient LC openings to maintain supplies of essential goods ahead of Ramadan, assuring that adequate dollars would be made available for business requirements.

Bangladesh Bank’s monetary policy has also sought to contain inflation by limiting private sector credit growth to below 8% during the first half of the 2024-25 fiscal year (July-December), without reducing the policy rate on bank lending.

A managing director of a private bank said that although sufficient dollars are available, businesses have reduced imports of capital machinery. “Most of the current imports are essential goods. Political uncertainty is discouraging new investments, and banks are cautious in extending new loans. As a result, private sector credit growth in August fell below 6%, marking a year-long decline, with July showing the lowest growth in the past decade,” he said.

The Bangladesh Bank official added that September’s sudden rise in LC openings is partly due to the upcoming Christmas season, which could increase imports in line with exports. “Remittance inflows and export earnings this fiscal year have grown significantly compared with the previous year, leaving banks with more dollars, enabling them to open more import LCs,” the official explained.